Invest in UK rental property

Nomo Property Finance is a fully-digital, Sharia-compliant finance product helping you to buy or refinance a rental property in the UK.

Finance or refinance your property purchase with Nomo, earn regular income through rent, and start building a global property portfolio.

Easy application process in the Nomo app

Quick decision on your property finance application

Manage your finance in the app

Looking to earn income from UK property?

Owning a UK rental property can help you to profit from the UK rental market, diversify your investments and grow your wealth. Investors can earn regular monthly income from rent payments.

Nomo Property Finance gives you the opportunity to buy property in the UK. Our app will also guide you through your digital property finance application and support you at every stage of the process.

Explore Nomo's property finance products here.

Please note, we currently only offer finance for properties in England and Wales.

How to get started

Here's an example of the Nomo Property Finance journey if you're just starting your property search:

See how much you could receive

Please refer to our Eligibility Criteria for Rental Property Finance.

Open a Nomo account

You first need to apply for a Nomo bank account, which takes just minutes. Download the app now.

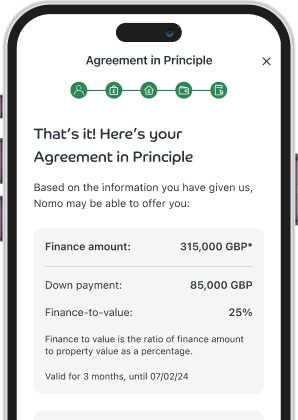

Get an Agreement in Principle in the Nomo app

This is a certificate showing a more accurate estimate of the amount you could receive in property finance.

Make an offer on a property

Your Agreement in Principle shows the property agent and seller that you're in a position to make a serious offer.

Apply for Nomo Property Finance

Once you’ve agreed on the property purchase, you can start your application in the Nomo app.

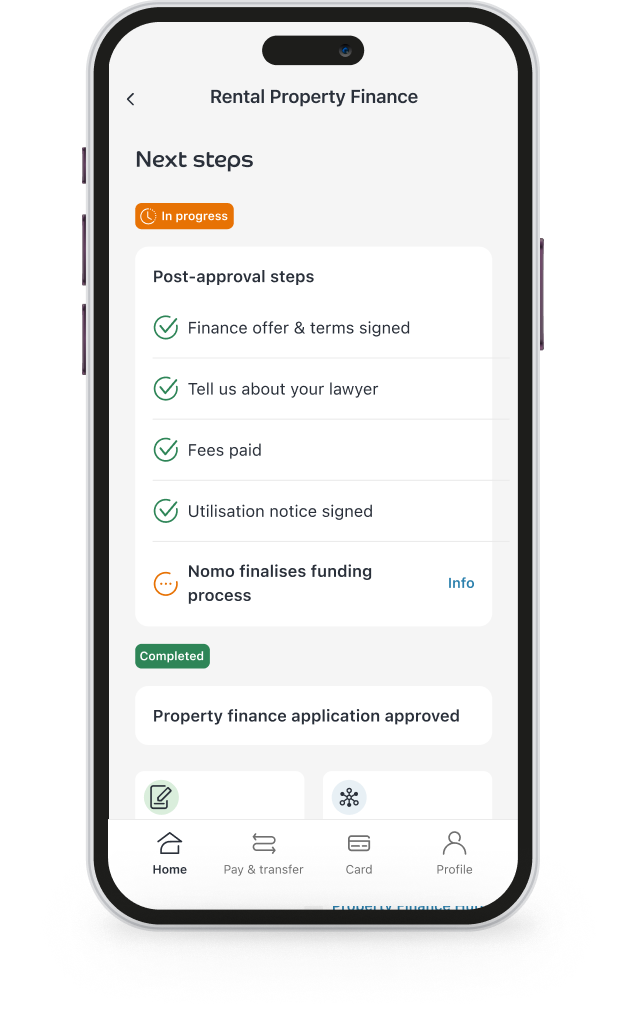

Get a decision on your application

When approved, you will receive a finance offer from us.

After you accept it, there will be few additional tasks to complete before we can start arranging the finance for you.

Property Finance Hub

Find below useful resources to get you started on the property finance journey.

Quick guide to buying UK property

Finding a property in the UK, and key things to consider when applying for finance.

Our property finance products

Learn about our profit rates and the key features of our property finance products.

Nomo eligibility criteria

See if Nomo Property Finance is right for you by finding out if you're eligible to apply.

Property finance fees & charges

Learn about the different types of fee involved with property finance.

Need some help?

Find answers to frequently asked questions about Nomo Property Finance in our Help section.

Residential Property Finance

Looking for a home in the UK? We offer finance to help you buy a place to call your own.

If you have any questions about Nomo Property Finance, please contact us at propertyfinance@nomo.bank

YOUR RENTAL PROPERTY MAY BE AT RISK IF YOU DO NOT KEEP UP THE PAYMENTS ON YOUR NOMO PROPERTY FINANCE

Nomo Rental Property Finance products fall outside the scope of regulation by the Financial Conduct Authority (FCA) and the protection of the Financial Services Compensation Scheme (FSCS) and the Financial Ombudsman Service (FOS).

The information provided on this website is of a general nature. Nomo Bank and its affiliates do not provide tax,legal or accounting advice and you should consult your own advisors before engaging in any transaction.

Are you ready to begin the journey?

Experience Sharia-compliant digital banking today.