5 reasons you'll love Nomo's multi-currency accounts

Nomo bank

3 Apr 2023

Multi-currency has landed on Nomo, but what does it mean for you?

Read on to discover 5 key benefits of using multi-currency accounts with Nomo, and who we think will love the new features!

Zero international spending fees

One of the most frustrating parts of travelling and shopping abroad is having to pay a little extra for spending with your regular bank card in your home currency.

This could be during a family trip, while you’re studying abroad, or even if you’re just buying something from an online shop based in a different country.

With Nomo multi-currency, you can pay in the local currency with zero hidden fees or unexpected costs. So whether you’re making purchases in New York, London, Paris, Madrid or Dubai, you can spend without the extra charges.

Forget prepaid cards

Leave prepaid cards in the past – multi-currency accounts are here and they make life much easier when you’re preparing for your trip!

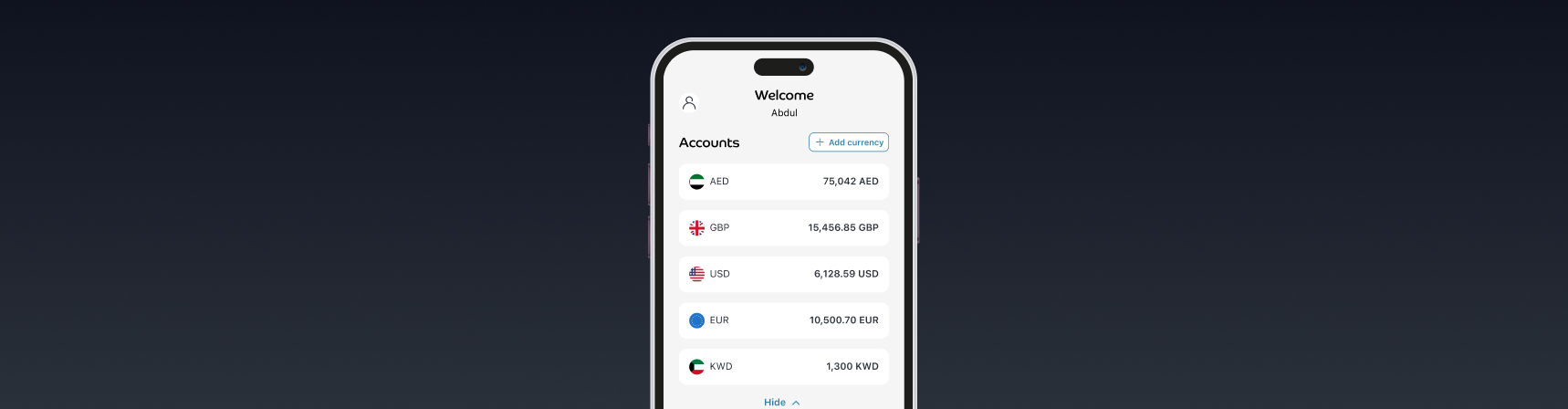

Instead of ordering and crediting a prepaid card, simply open the Nomo app, exchange your money into the currency you need and start spending. You can open accounts in KWD, AED, SAR and EUR, alongside the GBP and USD accounts that are opened automatically when you join Nomo.

Once you’ve opened a new currency account, it’s automatically added to your Nomo debit card so you’re ready to spend in the local currency in over 30 countries!

Use Apple Pay fee-free

There’s nothing quite like the convenience and speed of paying for your morning coffee with your iPhone or Apple Watch. It’s even better using Apple Pay while on vacation or an international business trip, making your wallet one less item you have to think about!

Spending with Apple Pay on Nomo is fee-free and stress-free, both at home and abroad, and your new currency accounts are automatically loaded onto Apple Pay if you’ve already added Nomo to your Apple Wallet.

Avoid high fees on international transfers

When sending money internationally, the last thing you want is high, unexpected exchange fees that result in less money actually reaching your recipient.

With Nomo, you can exchange money before you send it, and you send money in the local currency, so there’s no need for any more exchanges and hidden fees. We use the mid-market exchange rate from our multi-currency partner, which is how we try to give you a fair rate for your transfer.

Plus, outbound payment via SWIFT on Nomo cost a flat fee of 6 GBP (or equivalent cost in another currency) which can save you money when sending large amounts of money – for example, when sending the down payment on a house or paying university fees. On top of this, receiving money is always fee-free with Nomo!

All of your currencies on one card

One card, six currencies. We’ve completely streamlined your travel spending – it’s never been easier to spend like a local around the world, even if you’re visiting multiple countries on the same trip. So if you’re planning to stop off in Paris or Rome on your way to London this year, your Nomo is all you need!

With multi-currency accounts from Nomo, you can exchange money instantly into the local currency, so you know exactly how much you’re spending at the checkout. Our low, transparent exchange fees are just 1% (or 2% at the weekend).

Ready to get started? Explore multi-currency accounts from Nomo here.